Canon and Sony made up a vast majority of the camera sales in 2020, which saw a 40% dip in market size globally during what was an incredibly rough year for the industry and the market is only predicted to shrink further.

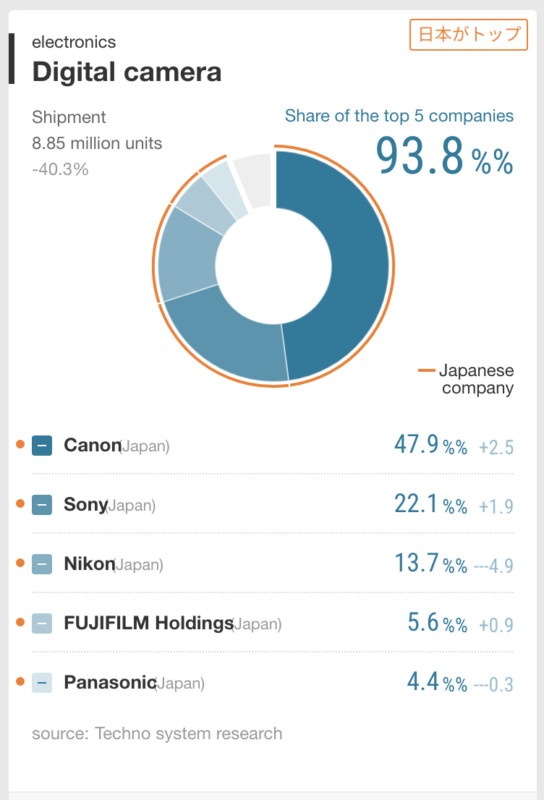

As part of a major annual report by Nikkei — the “Major Product and Sevice Share Survey” — that breaks down market share across numerous industries in Japan by manufacturer (and summarized by Digicame-Info), Canon, Sony, and Nikon were called out as owning 83.7% of the entire digital camera industry, but specifically, Canon and Sony own a whopping 70% between the two of them. Canon owns 47.9% of global shipments and Sony 22.1%. Despite a rough year overall, Sony and Canon actually saw an increase in the number of units shipped last year (Canon rose 2.5% and Sony rose 1.9%) while Nikon’s fell 4.9%.

Nikkei writes that the global market for cameras had already been falling due to the spread and popularity of smartphones, but in 2020 the coronavirus pandemic exacerbated the issue and the global market fell by about 40%. At numerous points over the last year, PetaPixel reported the state of the industry, which bottomed out near the end of the summer before bouncing back in time for the holiday season. Clearly it did not fully recover, however. Still, despite the struggling market, Canon not only grew its share but also shipped more than twice the number of products than second-place Sony.

While Nikon recently reported a solid turnaround from a disastrous 2020 — the company showed both an increase to revenue and profit as well as significant recovery in sales of digital cameras — the company not only lags far behind Canon and Sony in units shipped but continues to struggle mightily with producing new products even now. It’s difficult to ascertain the actual demand for Nikon products because while the company is producing new cameras, changes to its manufacturing pipeline have made it so Nikon cannot produce nearly the volume it needs to for products launched nearly a year ago. The Nikon Z7 II, for example, is still not stocked at United States retailers and it’s unclear if all the pre-orders for the cameras from its launch in the fall of 2020 have been fulfilled. The launch of the Z fc looks promising, but Nikon was again forced to delay shipping certain units due to a combination of demand and lack of manufacturing capability.

Also of note, Panasonic and Fujifilm rounded out the top five camera brands by market share in Nikkei’s report, with 5.6% and 4.4% share respectively. Fujifilm saw a modest gain of 0.9% while Panasonic dipped 0.3%. As noted by DPReview, the positions of these manufacturers have not changed from 2020, but trends are headed in the wrong direction for brands like Nikon and Panasonic. Even Fujifilm isn’t growing at a rate that feels sustainable, and the company may agree: it has already shown that it plans to invest heavily outside of cameras and into the much more profitable healthcare sector.

With Canon and Sony controlling such a large chunk of the market, multiple brands including Nikon, Fujifilm, and Panasonic as well as others that didn’t even make the top five like Olympus and Leica are left fighting over figurative scraps. Unless Canon or Sony cede some of the market share back — which doesn’t appear to be likely given both grew over the last year — it seems as though it would be difficult for all of these brands to survive on such a small chunk of a shrinking market.

Image credits: Background of header photo licensed via Depositphotos.